Cash application for Centime Merchant Services

Learn how payments flow from your customer to your General Ledger (GL), including visibility within Centime and how settlements and fees are applied. The process ensures your bank register stays aligned with your accounting system.

🔁 End-to-End Payment Journey

1. Customer Initiates Payment

- A customer pays open invoice(s) through the Customer Portal, resulting in one payment.

- A Payment ID is created in Centime and the Settlement status is "Payout Pending."

- The invoice Status updates to "Paid."

- A payment receipt is sent to the Customer and a notification is sent to all AR users with permission, “Assign workflows, edit custom fields, invite to portal and enrol autopay.”

- Reminders are paused and the invoice is flagged accordingly in monthly statements.

2. GL Posting & Payment Authorization

- Each payment is temporarily posted to the Undeposited Funds GL account.

- If applicable, discounts or surcharges are also recorded via journal entries to designated GL accounts set in your Online Payments Settings.

- This is ongoing as payments are made throughout the day.

3. Daily Net Payout: Settlement and Deposit

At the end of each business day:

- Centime consolidates all authorized payments into two Deposits in your GL one for all ACH transactions and one for all CC transactions.

- ACH Timing: 3 to 4 business days (6:30 PM ET cut off)

- Credit Card Timing: 1 to 2 business days days (9:30 PM ET cut-off)

- Centime records the total transaction fee for ACH and CC, posted to your Transaction Fee GL account.

- Your accounting records now match the net amount received in your bank.

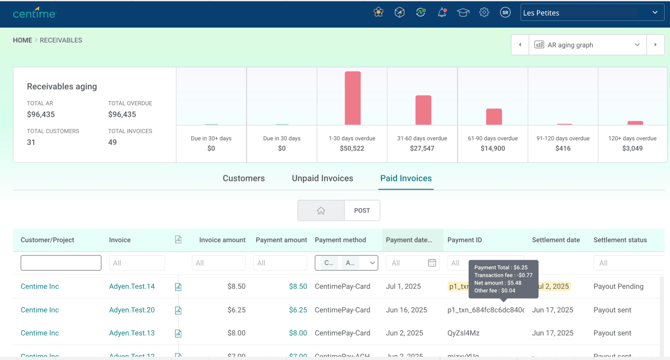

👁 Visibility in Centime

In the Paid Invoices tab Centime will show you the Payment ID and Settlement date.- Payment ID: By filtering for Payment ID you can see all invoices included in the transaction.

- Hovering over Payment ID: This shows the total payment amount, transaction fees and the net amount* for each transaction.

- Settlement Date: This shows you when you can expect to receive a payment or when a payment has settled.

- If the date is highlighted in Yellow, it means that the payment has not settled yet and this is an estimate. The estimate takes into account weekends and holidays.

- If the date is not highlighted, this represents the actual settlement date.

- You can sort of filter this table to see all invoices included in the settlement.

- Hovering over Settlement Date will show you the total settlement amount.

*There may be a small discrepancy (typically between $0.01 and $0.10) between the net amount and the final settlement amount due to occasional additional fees incurred upon settlement. However, the settlement amount will always match the amount you receive.

📘 GL Details & Posting Breakdown

- Learn how Centime applies cash in NetSuite.

- Learn how Centime applies cash in QuickBooks.

- Learn how Centime applies cash in Sage Intacct.

Relevant statuses in Centime

|

Action |

Invoice Status |

GL Post Status |

Settlement Status |

Status in GL |

|

Customer completes a successful payment |

Paid |

Posting in progress |

Payout Pending |

Paid |

|

After GL sync & post to Undeposited |

Paid |

Posted |

Payout Pending |

Paid |

|

Daily Net Payout pushed to client account |

Paid |

Posted |

Payout Sent |

Paid |

🔄 Status Values Reference

Invoice Status

- Unpaid: No payment has been made

- Partially Paid: Only a portion of the invoice was paid

- Paid: Payment completed in full

- Posted Manually: GL entry manually triggered

- Posting Pending: Awaiting posting initiation

- Posting in Progress: Payment is currently syncing

- Posting Failed: Error occurred in posting

- Posted: Payment successfully recorded

Settlement Status (to Deposit)

- Payout Pending: Payment has not yet settled

- Payout Sent: Funds have been deposited

- Payout Failed: Payout process encountered an error